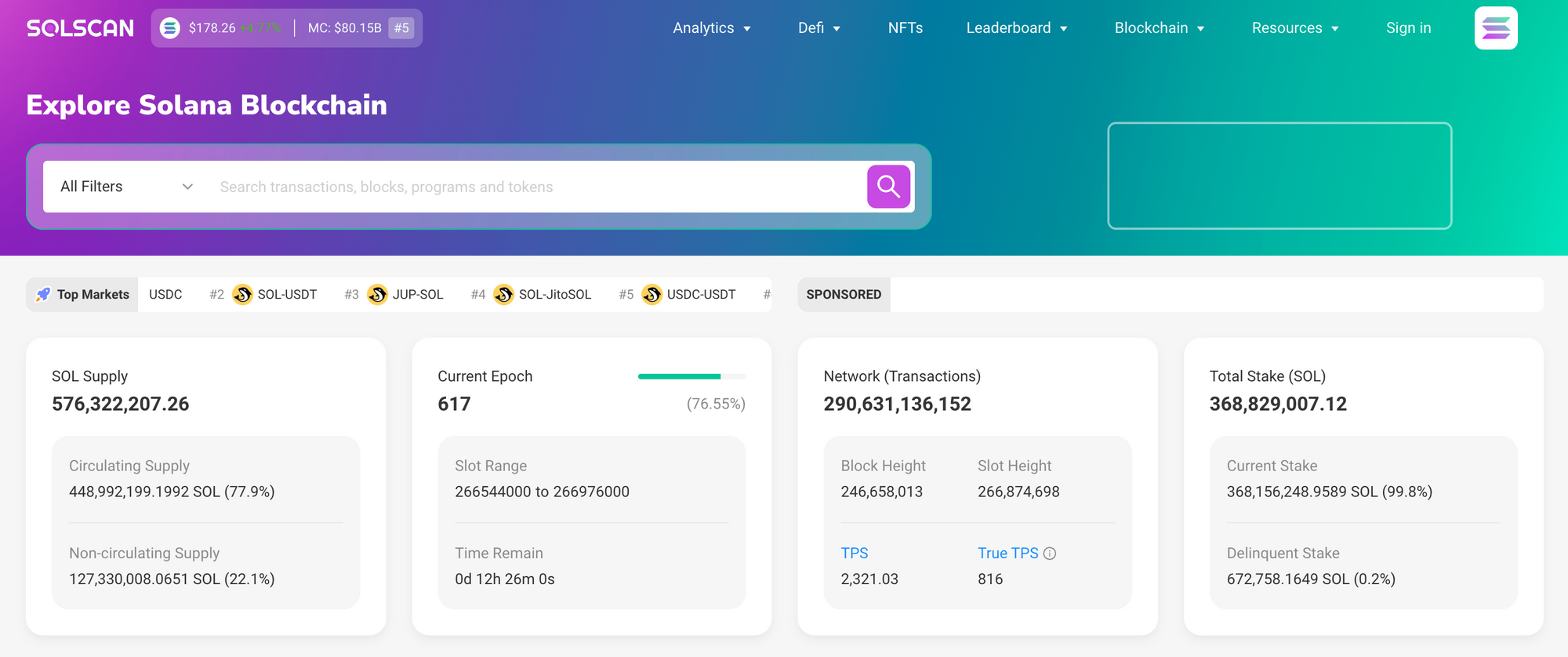

Okay, so check this out—I’ve been poking around Solana explorers for years. Wow! The first thing that hits you is speed. My instinct said this would be clunky, but honestly, Solscan moves like a subway at rush hour when it’s working right. Seriously? It really does.

At first glance the UI seems straightforward. It’s clean, fast, and practical. But there’s more under the hood than meets the eye, and that part matters if you track tokens or NFTs with any seriousness. Initially I thought explorers were mostly for devs, but then I realized everyday collectors and traders need them too. Actually, wait—let me rephrase that: explorers serve multiple audiences, and good ones balance power with accessibility.

Here’s what bugs me about many alternatives. They either overload you with charts and tech-speak or they hide useful data behind confusing menus. Hmm… Solscan mostly avoids both extremes. On one hand its dashboards surface the essentials quick. On the other hand, digging deeper reveals detailed transaction traces, token histories, and token holder distributions. Though actually, some parts still feel novice-focused while powerful features sit a click away.

Wow! Token tracking is where Solscan shines. You can search by mint address, by token symbol, or by wallet and instantly see supply, decimals, and transfer history. Medium-level users will appreciate the holder concentration charts. Longtime observers will like the exportable CSVs and the way the interface surfaces token metadata and verified project badges, which help separate legit mints from spammy copycats that pop up on Solana regularly.

Really? NFT tracking on Solscan surprised me. The collection pages show floor price snapshots alongside recent trades. There’s a quick visual of rarity traits, and you can drill down into trait frequency without needing another tool. My instinct said I’d still need an external rarity engine, but somethin’ about the way Solscan aggregates marketplaces and trades reduces that friction. It’s not perfect, and some collections use custom metadata that complicates parsing, but the baseline info is robust.

Whoa! Transaction tracing is beautifully granular. You can follow a single transfer through program calls and see inner instructions. This matters when you’re debugging a failed swap or assessing an on-chain exploit attempt. On the technical side, Solscan’s ability to show both confirmed and finalized states helps when there’s fork ambiguity or pending confirmations. Initially I assumed that level of detail was only for developers, but it’s useful for power collectors too.

Performance-wise, Solscan keeps up. The site handles high-volume traffic without getting sluggish most of the time. On some network spikes you might notice delays, but those are usually Solana-wide congestion effects, not the explorer itself. I’m biased, but I’ve compared it with other explorers and the responsiveness tends to be better—especially when browsing NFTs and token holders where UI updates can be heavy.

How I Use Solscan Daily

I check token mints quickly when someone posts a new project. Wow! I also use it to confirm wallet receipts after trades. For NFTs I follow mint transactions live. On a typical day I watch a couple of wallets, scan new program interactions, and verify suspicious trades. Something felt off about one mint last month, and tracing its transfers on Solscan revealed an automated rinse pattern—saved me time and money. I’m not 100% sure I would’ve spotted that on a simpler tool.

Developers get value too. The contracts explorer, though not as flashy as a full IDE, surfaces program logs and instructions which help during test deployments. Long complex traces can be exported for deeper analysis later. It’s the kind of practical support that cuts debugging cycles down.

One small gripe: sometimes metadata parsing hiccups leave image links missing. It’s annoying, sure, but it’s usually a metadata inconsistency from the mint itself. (oh, and by the way…) Solscan will show raw metadata so you can quickly spot whether the issue is on-chain or a broken IPFS link off-chain.

Security & Trust Signals

Solscan displays verification badges and links to popular marketplaces. Short sentence. That matters because social proof reduces scam risk. Medium-level metrics, such as holder distribution and token mint history, give practical signals for due diligence. Longer investigations can reveal sock-puppet wallets or highly centralized supplies, which in turn inform buy or hold decisions.

I’ll be honest: no explorer is a silver bullet. On one hand the data is authoritative because it’s on-chain. On the other hand, on-chain doesn’t mean trustworthy; a project can still lie in off-chain communications or use deceptive marketing practices. My instinct said trust the chain. Then I realized trust needs context—wallet clustering, timing, and external verification all matter.

Check this out—if you want to try Solscan directly, here’s the official access point: https://sites.google.com/cryptowalletextensionus.com/solscan-explorer-official-site/ I use it as my go-to quick-check before signing any transaction or participating in mints. It isn’t the only tool I use, but it’s comfortably among the top ones.

Pro Tips (practical, not theoretical)

When assessing a token, always look at the top 10 holders. Short tip. If top holders control most supply, that’s risk. When tracking NFTs, watch for wash trading patterns—repeated low-volume sales among a tight cluster of wallets. Those patterns often show up as rapid successive trades that don’t materially change floor prices. For developers, use the export features to archive event histories—timestamped evidence is invaluable if disputes arise or audits are needed.

Something else worth noting: Solscan’s search accepts partial addresses and symbols, which speeds routine lookups. This small UX nicety matters when you’re juggling multiple tabs and chasing alerts. It saves seconds that add up over weeks. And seconds equal fewer mistakes.

FAQ

Can Solscan track all Solana tokens and NFTs?

Mostly, yes. It indexes on-chain mints and transactions and surfaces token metadata. Some custom mints with nonstandard metadata can be harder to parse, though. Also, off-chain metadata or broken IPFS links will affect visual previews but not the underlying on-chain data.

Is Solscan reliable during network congestion?

Generally reliable. But Solana congestion affects any explorer. Solscan shows confirmed versus finalized states which helps in ambiguous cases. If you’re doing high-value transfers, wait for finalized confirmations.

Do I need any account to use Solscan?

No account is required for most features. You can browse token pages and transaction histories freely. Some integrations or community features might request sign-ins, but core explorer tools remain open.

Alright, so where does that leave us? Solscan is fast, detailed, and pragmatic. It has quirks—minor parsing issues and the occasional UI curveball—but it does the heavy lifting without pretending to be everything. I’m biased toward tools that get out of the way while giving access to deep data. Solscan does that, and for anyone tracking tokens or NFTs on Solana, it’s worth keeping in your bookmarks. Somethin’ about it just clicks.